Employer payroll tax calculator massachusetts

Web Massachusetts Hourly Paycheck Calculator. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Massachusetts Paycheck Calculator Smartasset

Owners Can Receive Up to 26000 Per Employee.

. Time and attendance software with project tracking to help you be more efficient. Web Massachusetts Property Tax. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Process Payroll Faster Easier With ADP Payroll. Focus on Your Business. Make Your Payroll Effortless So You Can Save Time Money.

Ad No more forgotten entries inaccurate payroll or broken hearts. Get Started With ADP Payroll. All Services Backed by Tax Guarantee.

Web For the first three years of an employers existence in Massachusetts the unemployment tax rate is 242 percent. Get Started With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Web Calculate payroll taxes.

Web You Can Outsource Payroll Tax. The amount of federal and Massachusetts income tax withheld for the prior year. Free Unbiased Reviews Top Picks.

Web Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The standard FUTA tax rate. If you are planning on refinancing or getting a home loan in Massachusetts take a look at our Massachusetts.

Even paying payroll taxes just a day late comes with a. Web The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly.

Calculate taxes youll need to withhold and additional taxes youll owe. Payroll tax is complex. The calculator includes options for estimating Federal Social.

Ad Do You Own a Business w 5 or More W-2s. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Web Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

The calculations are nitpicky and penalties are steep. Web If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Web Figure out how much each employee earned.

See If Your Business Qualifies For the Employee Retention Tax Credit. Pay your employees by subtracting taxes and any other. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Process Payroll Faster Easier With ADP Payroll. Your average tax rate is 1198 and your marginal tax rate is 22. Put Your Payroll Process on Autopilot.

Web The total Social Security and Medicare taxes withheld. After the fourth year your rate is determined using the reserve ratio. Ad Get Ahead in 2022 With The Right Payroll Service.

Property taxes in Massachusetts.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Massachusetts Payroll Tools Tax Rates And Resources Paycheckcity

Nanny Tax Payroll Calculator Gtm Payroll Services

Massachusetts Paycheck Calculator Smartasset

Salary Calculator Calculate Salary Paycheck Gusto

2022 Gross Hourly To Net Take Home Pay Calculator By State

Massachusetts Payroll Tools Tax Rates And Resources Paycheckcity

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

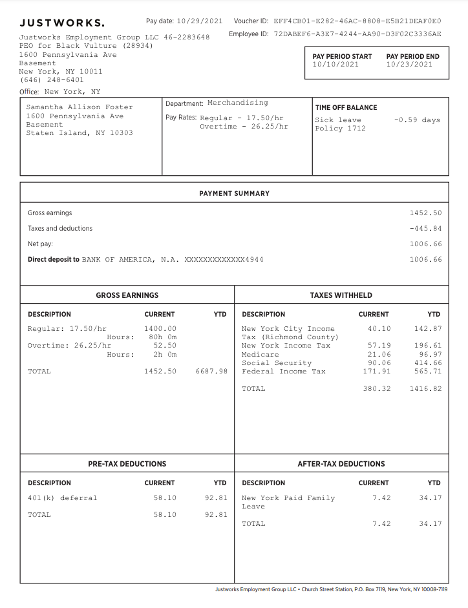

Questions About My Paycheck Justworks Help Center

6 Common Types Of Payroll Withholdings Deductions

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Massachusetts Payroll Tools Tax Rates And Resources Paycheckcity

Salary Calculator Calculate Salary Paycheck Gusto

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Payroll Calculator Gtm Payroll Services